In April, Vermont released an RFP for its Next Generation Accountable Care Organization (Vermont Next Gen ACO) program. Under this program, Vermont plans to build on the state’s existing Medicaid ACO model, the Vermont Medicaid Shared Savings Program (VMSSP), which saved $14.6M in its first year and delivered high-quality health care to more than 60,000 Medicaid enrollees across the state. Although Vermont’s Next Gen ACO is structured similarly to the Center for Medicare and Medicaid Services’ (CMS) Next Generation ACO Model (Next Gen) that serves Medicare beneficiaries, Vermont’s new ACO approach is attempting to go beyond its Medicare-inspired counterpart to make providers even more accountable for cost and patient outcomes.

Vermont’s Medicaid environment is uniquely suited for this transformative payment experiment. Instead of purchasing health care services through a managed care contractor, the Department of Vermont Health Access (DVHA) operates a public Medicaid managed care model. This gives Vermont direct access to its providers, with whom it has established solid relationships. With roughly 190,000 Medicaid enrollees, the population is small enough to allow the state to closely monitor quality outcomes.

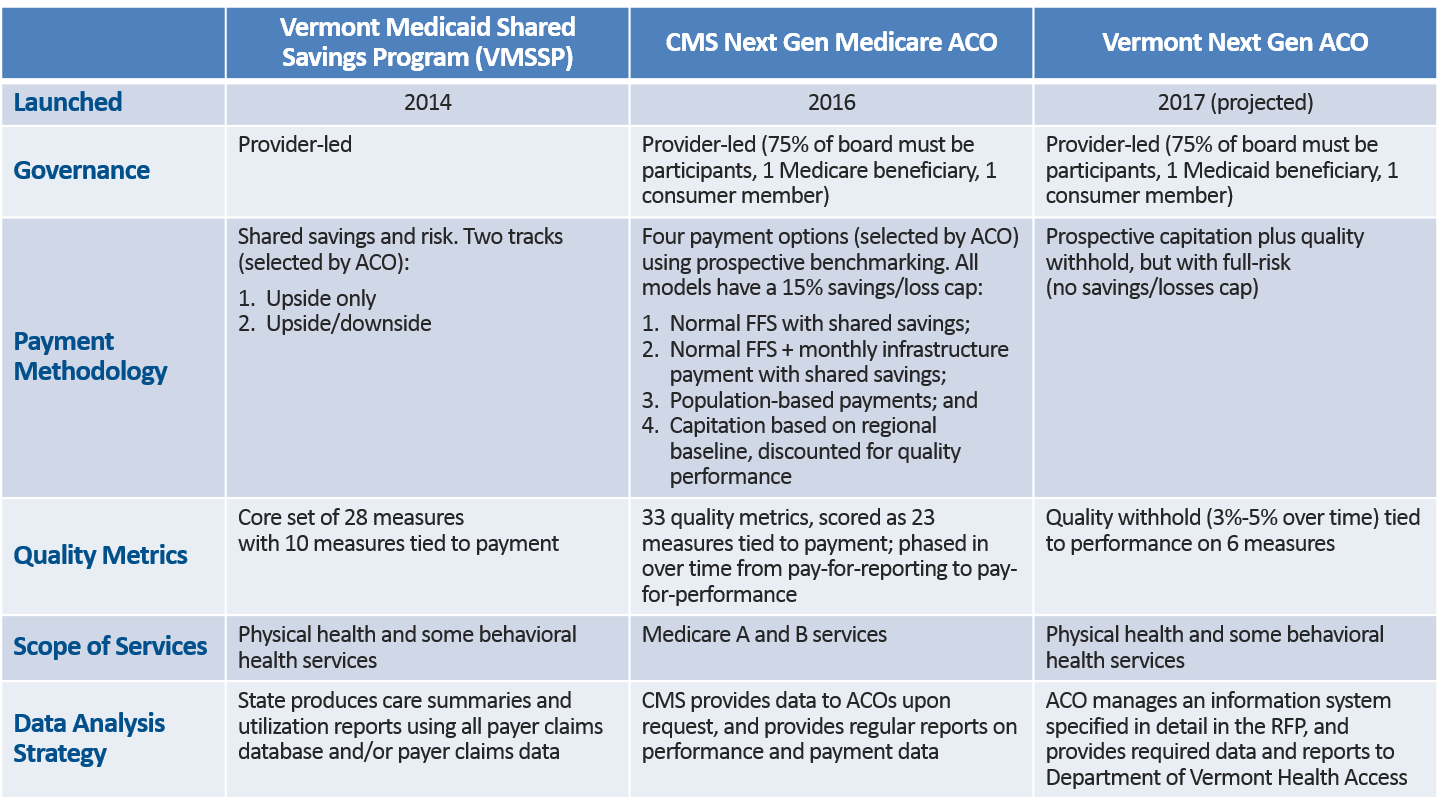

A comparison of the VMSSP, the Next Gen Medicare ACO, and the Vermont Next Gen ACO model is below (click to enlarge).

Overview of the Vermont Next Gen ACO Program

Vermont has introduced a full-risk capitated payment arrangement, with a quality withhold that grows over time from three percent to five percent of capitation. The withhold can be recouped by performance on six quality metrics. The state also offers the option for participating ACOs to perform their own utilization management, subject to state requirements, or to let the state continue to perform these activities.

Comparison to CMS’ Next Gen Medicare ACO Model

Vermont’s Next Gen ACO model, expected to begin in January 2017, aligns closely with the Medicare Next Gen model, staying true to the state’s aspirations for achieving an aligned all-payer health system. Many details, such as governance requirements, patient attribution, and, importantly, prospective payment, are very similar to the Medicare model. There are also key differences. For example, the Vermont Next Gen model requires participating ACOs to accept full risk for their Medicaid patients in exchange for a capitated payment, while the Medicare Next Gen approach includes the options of prospective payments paired with a shared savings methodology or a partial capitation arrangement with gains/losses capped at 15 percent of benchmark projections.

Comparison to the Vermont Medicaid Shared Savings Program

The Vermont Next Gen ACO also departs from VMSSP, the state’s current Medicaid ACO program, in several important ways. First, the model shifts from a shared savings methodology to prospective payment. The state also pared the number of quality metrics from 28 to six. All six metrics in the Vermont Next Gen ACO model are linked to payment. In the VMSSP model, only 10 of the 28 metrics are tied to payment. The services for which participating ACOs will be accountable are the same as those that were included in the VMSSP, though there is the potential for integration of additional Medicaid-covered services in later program years. Finally, the state suggests risk stratification methodologies that it did not require in the shared savings-based model.

Potential Impacts for Patients and Providers

The Vermont model will undoubtedly have an effect on providers and patients in the state. ACOs are already prevalent in the state’s Medicaid, Medicare, and commercial sectors, so patients, providers, and payers are familiar with this arrangement. On the one hand, in shifting from shared savings toward a capitated model with prospective payment, Vermont’s new Next Gen ACO could provide patients with improved care coordination and a more patient-centered experience, while curbing health care cost growth for payers. On the other hand, capitated payment arrangements, like those in Vermont’s Next Gen ACO, theoretically have the potential to encourage stinting on patient care to achieve incremental savings, though this will be monitored closely by the state through the six quality metrics linked to payment.

From a provider perspective, a move toward a capitated environment tends to encourage large provider coalitions forming ACOs to help bear financial risk. While these large organizations will have advantages in terms of network adequacy, access to care, and care coordination, some worry they could also wield too much market power. In Vermont, these large ACOs have already formed, and there have been few adverse effects. The state’s two Medicaid ACOs, OneCare Vermont and Community Health Accountable Care (CHAC), are already large provider coalitions that function statewide. They both have successfully managed a shared savings arrangement, while improving quality and reducing costs. This experience indicates that OneCare and CHAC may be capable of taking the next step toward greater accountability by entering a capitated arrangement.

Looking to the Future

Vermont’s new capitated model continues a trend toward prospective payment that began in earnest with the federal Pioneer ACO program, and advanced with the Next Gen Medicare model. In addition, Maryland’s all-payer hospital waiver and Oregon’s CCO program have brought capitated arrangements to their respective provider- and payer-led Medicaid value-based payment (VBP) efforts. Maryland’s program in particular has shown dramatic results in its first year. While Vermont’s environment is ripe for this kind of reform due to its existing large multi-payer ACOs, challenges may arise in states that wish to pursue a similar model, such as provider readiness to accept risk and the delineation of payer and provider responsibilities. Nevertheless, we expect to see this trend toward greater provider accountability for costs and quality in VBP programs continue, as more states consider such models for their Medicaid program.